The story of New London starts back in 2012 in the small coastal Connecticut community.

Embroiled in controversy, the school district was being taken over by the state because they were short on funding. And there would be no overnight solution to their financial problems.

To secure their future, the New London district would have to increase revenue themselves. But how would they now, when revenue challenges were what they couldn’t overcome before?

They’d have to find a way to work with the state’s funding structure.

Like most states, Connecticut gets the majority of funding from state and local sources. At roughly 56%, local property taxes are responsible for the biggest share. Which leads to New London’s struggles. The town is only six square miles, and less than 50% of it constitutes taxable land. Property taxes alone could not be the solution.

Since Connecticut’s education cost sharing formula allocates funding per student and per a town’s property wealth, the district could grow enrollment to tap into more state aid. But to enroll more students, they’d have to turn to surrounding communities.

Realizing that high-quality magnet programs could serve their own families and those from neighboring towns, New London sought and secured state approval to become the first inter-district all-magnet district in the state.

The move would position the district for enrollment but also equity gains since, as magnet schools, they’d be governed by racial isolation reduction rules that stipulated certain percentages of the enrolled must be pupils of racial minorities.

Recruiting and retaining diverse students then would be essential to securing the district’s future. As Kate McCoy, executive director for strategic planning, explains, “We are intentionally looking for a diversified student population.”

To get the students they needed, New London’s leaders developed a year-round approach. Crucial to their strategy would be outreach and marketing plus a data-rich, highly configurable application and lottery program.

Working with SchoolMint, they achieved the latter. “With SchoolMint [during the application phase of enrollment], we’ve really just had a lot of success because we can see exactly who’s applying, where they’re from, and what grades they are in,” says McCoy.

The conversion funnel in SchoolMint’s Application and Lottery Management tool provides a detailed picture of all applicants as they move through the process in real time.

Data can be dissected by every field on a student’s application, revealing detailed profiles of who is first interested, then has applied, then has received an offer, and then has finally registered. This also means administrators can see what student populations haven’t engaged. And that’s been crucial for New London.

Asking “Are we short anywhere? Do we need to be working harder to get this town or that town,” McCoy and her team can try to boost applicant numbers where they need them, right in the middle of the application season, through targeted outreach.

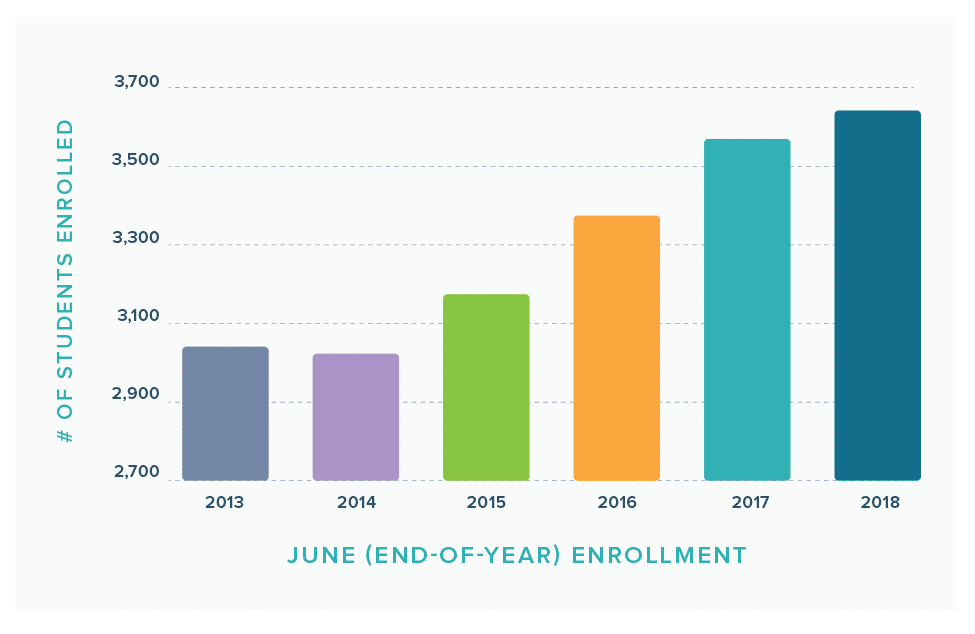

With four straight years of steady growth currently behind them, the all-magnet gamble has paid off. New London has seen 18% total enrollment growth since the 2012–13 school year. And now, in a more financially stable place, they’ve been able to build new schools.

With their biggest financial hurdles behind them, New London has laid the foundations for a sustainable school system — for the students of today and tomorrow.